Bank Rakyat Fixed Deposit

Posted By admin On 14/07/22Bank Rakyat deposit interest rates presented on Malaysia Fixed Deposits are reviews of financial products taken from banks and financial institutions in Malaysia. Bank Rakyat deposit interest rates information is meant for personal use only.

- Bank Rakyat Fixed Deposit Promotion Overview. Bank Rakyat Fixed Deposit Promotion can offer you many choices to save money thanks to 20 active results. You can get the best discount of up to 50% off. The new discount codes are constantly updated on Couponxoo. The latest ones are on Jan 22, 2021.

- RM60,001 to RM10,000,000 per certificate. Minimum tenure is one (1) day. Tenure of more than five (5) years is subject to approval by the Securities Commission of Malaysia. Profit rate is based on the Bank's prevailing profit rate and determined upon placement of deposit together with the tenure.

Apply Now

Terms & Condition

Product brochure

Product disclosure sheet

- Savings-i & Deposit-i

Term Deposit Account-i assists you for a smart financial management planning. You may increase profit potential and expand your financial management systematically and more securely.

- Personal Accounts

- Joint Accounts

- Trust Accounts

- Association/Cooperative/Corporate Accounts

- Government Entity Accounts

- Profit rate is determined at the opening of an account

- Deposit of more than RM5,000, profit can be paid monthly (minimum 6 months)

- Automatic renewal upon request

- Deposit Certificates may be used as collateral for other Syariah-compliant financing

- Takaful coverage

Bank Rakyat Fixed Deposit Interest Rate 2020

- Individuals (individual, joint or trust

- Cooperatives that are established and registered in Malaysia

- Charities/Club/Association that are established and registered in Malaysia

- Private and Government corporate company

- Government Agencies

| DURATION | MINIMUM DEPOSIT |

|---|---|

| 1 month | RM5,000 |

| 2 to 60 months | RM500 |

| TRANSACTION | CHARGE |

|---|---|

| Replacement of lost certificates | RM10.00 (stamp duty) |

| PERIOD OF DEPOSIT (MONTH) | RATES (%) |

|---|---|

| INDIVIDUAL | |

| 1 | 1.75 |

| 2 | 1.80 |

| 3 | 1.90 |

| 4 | 1.90 |

| 5 | 1.90 |

| 6 | 2.05 |

| 7 | 2.05 |

| 8 | 2.05 |

| 9 | 2.10 |

| 10 | 2.10 |

| 11 | 2.10 |

| 12 | 2.20 |

| 15 | 2.20 |

| 18 | 2.20 |

| 24 | 2.25 |

| 36 | 2.30 |

| 48 | 2.40 |

| 60 | 2.50 |

Apply Now

Product disclosure sheet

Uncallable Negotiable Islamic Debt Certificate (UNIDC) is a deposit product which pays a fixed profit rate on the given maturity date.

Bank Rakyat Fixed Deposit Rate

CONCEPT

Bank Rakyat Fixed Deposit Interest Rate

Tawarruq

FEATURES

Bank Rakyat Fixed Deposit

| Deposit Amount | RM60,001 to RM10,000,000 per certificate. |

| Deposit Tenure |

|

| Profit |

|

| Redemption |

|

| Payment upon maturity |

|

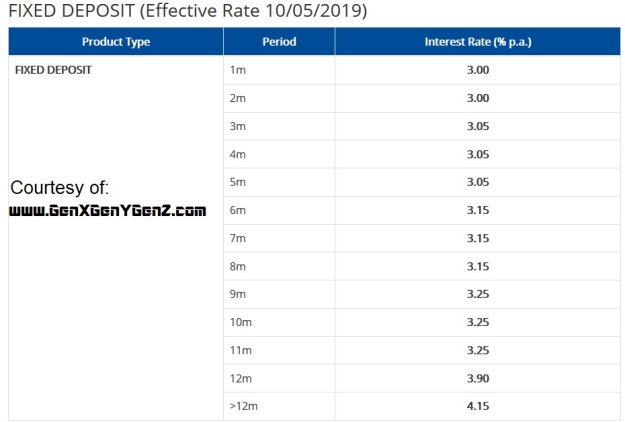

Bank Rakyat Fixed Deposit Promotion 2019

For further information, you may view the Product Disclosure Sheet (PDS).