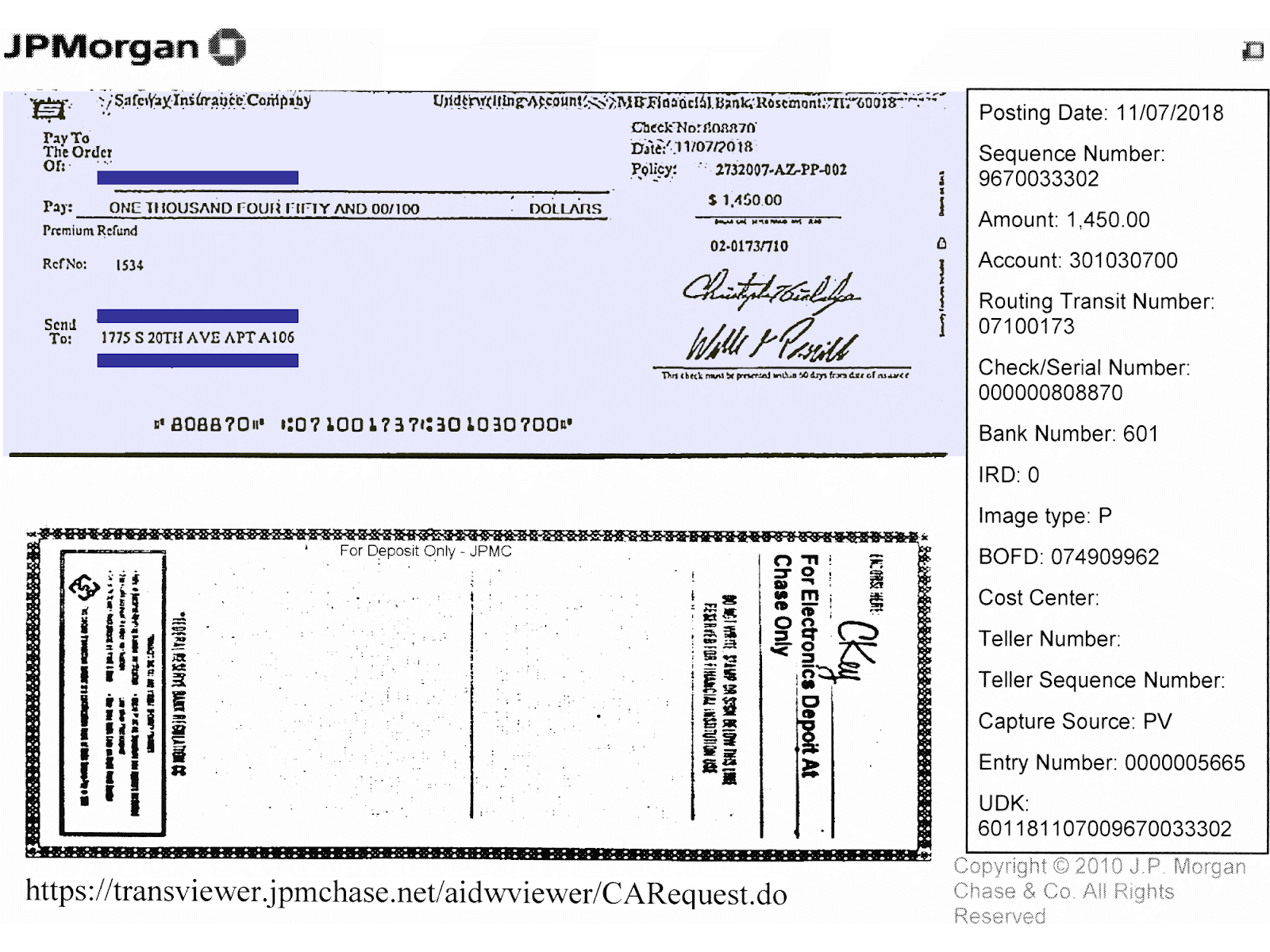

Chase Deposit

Posted By admin On 18/07/22- Chase Deposit Check Phone

- Free Chase Deposit Slip Printable

- Chase Deposit Check Online

- Chase Deposit Atm

- Chase Deposit Limit

- Chase Mobile Check Deposit Limit

Interest begins to accrue on the business day of your deposit. Interest for CDs is calculated on a 365-day basis, although some business CDs may calculate interest on a 360-day basis. The Annual Percentage Yield (APY) disclosed on your deposit receipt or on the maturity notice assumes interest will remain on deposit until maturity. Chase.com:. Click on the last four digits of your account number that appear above your account information, or. Select the “Account & routing number PDF” from the “Things you can do” menu. I authorize (name of business) and my bank to automatically deposit my paycheck into my.

- JPMorgan Chase Bank, N.A. Equal Opportunity Lender. As a reminder, PPP is an SBA program that JPMorgan Chase facilitates as an SBA lender. The PPP borrower remains responsible for performance of and all obligations under the PPP loan including all certifications. For the most recent details, visit SBA.gov and Treasury.gov.

- Deposits: Same as Funded column from Deposit Summary section; the portion of Net Deposits that are eligible for funding by Chase (as opposed to being eligible for funding by a third party, like American Express) Amount Transferred: Total dollar amount transferred to your bank account by Chase.

return to footnote reference1Savings-account interest is compounded and credited monthly, based on the daily collected balance. Interest rates are variable and determined daily at Chase's discretion and are subject to change without notice. Balance tiers are applicable as of the effective date of these rates and may change at Chase's discretion. Account fees could reduce earnings. CD interest is fixed for the duration of the term and is compounded daily.

return to footnote reference2For Chase Premier SavingsSM: Earn Premier relationship rates when you link the account to a Chase Premier Plus CheckingSM or Chase SapphireSM Checking account, and make at least five customer-initiated transactions in a monthly statement period using your linked checking account. See interest rates.

Savings Text Message Program: Message and data rates may apply. For Help call 1-800-935-9935. Reply STOP to 33172 to no longer receive Chase Savings text messages until you provide your consent again. Mobile carriers not liable for delayed or undelivered messages.

IMPORTANT INFORMATION

The content of this page is informational only. Accounts are subject to approval. The terms of the accounts, including any fees or features, may change. See the Deposit Account Agreement and Additional Banking Services and Fees for the terms and conditions associated with these products.

Saving money has never been as important as it is today. From unexpected personal finance challenges to global economic downturns that affect everyone, having some cash set aside can help all of us survive a rough patch.

As you know, I believe in the value of having some money set aside – as well as investing it as soon as you have the opportunity.

Taking advantage of the different promotions and bank bonuses makes saving money easier. Lots of companies we buy stuff from – from retailers to credit card providers – offer tons of promotions.

Chase Bank is an excellent company for that.

Chase Bank’s Current Promotions

Here are the current Chase Promotions you can benefit from today:

- Chase Total Checking: $200

- Chase SavingsSM: $150

- Chase Business Complete Banking: $300

- Chase Premier Plus Checking: $300

- Chase Private Client: $2,000

- You Invest by J.P. Morgan: up to $725

- Ink Business Unlimited Credit Card: $750

- Ink Business Cash Credit Card: $750

- Chase Freedom Unlimited: $200

- Refer Your Friends: up to $500

- Chase Sapphire Checking: expired

- Chase College Checking Account: $100

Chase Bank’s promotions, coupons, and bonuses can help you save thousands of dollars – if you’re smart about how you use them.

The good news is that getting started with Chase is so simple. Just open a bank account, upgrade to Chase Private Client, or get a Chase Bank card.

The bank also offers more than a few credit cards with cashback offers and payment waivers to sweeten the deal!

But let’s not get ahead of ourselves. In this post, I’m going to tell you what promotions Chase Bank currently offers – and what you’ll need to qualify.

When there’s an expiration date for an offer, we’ll also let you know so you don’t miss out!

Chase Total Checking Account – $200 Bonus

This offer is valid until 04/14/2021.

By opening a new Chase Total Checking account, you can collect the $200 bonus once you set up a direct deposit within 90 days.

- Open a new checking account online or get a coupon by entering your email if you want to open an account in a branch.

- Complete activities to qualify (deposit minimum amount or set up monthly direct deposits)

- Wait for your bonus money, which should reach you within 10 business days.

Chase SavingsSM Account – $150 Bonus

This offer is valid until 04/14/2021.

You can get a $150 bonus by signing up for a Chase SavingsSM account.

Once approved, you will have to 20 business days to transfer a total minimum amount of $10,000 in new money and keep that balance for 90 days.

Here are the steps you need to take to qualify for this offer:

- Use our link to get a Chase coupon after entering your email on the website.

- Deposit $10,000 of new money within 20 business days

- Maintain that balance for 90 days to receive $150 in your account within 10 business days.

Chase Business Complete Banking Account – $300 Bonus

The Chase Business Complete Banking Account bonus is perfect for small businesses.

Promotion

- Get your offer code.

- Open a Chase Business Complete Banking account

- Complete the following qualifying activities:

• Deposit a total of $2,000 in new money within 20 business days

• Maintain a $2,000 balance for 60 days

• Complete 5 qualifying transactions within 60 days of account opening. Qualifying transactions are: debit card purchases, Chase QuickAccept℠ deposits, Chase QuickDeposit℠,

ACH (Credits), wires (Credits and Debits)

Offer expires 04/15/2021.

Chase Premier Plus Checking Account – $300 Bonus

This offer has recently expired. Check back often in case it relaunches.

Chase Premier Plus Checking is an interest-earning checking account.

All you have to do is open a new checking account using the bonus offer below and make your first qualifying direct deposit within 90 days to receive your $300 account bonus.

- Open an account online or get a coupon by entering your email if you want to open an account in a branch.

- Complete activities to qualify direct deposit.

- Wait for your bonus money, which should reach you within 10 business days.

Chase Private Client – $2,000 Bonus

This offer is has expired. Check back at a later date in case in relaunches.

You can get a $2,000 bonus by upgrading your account to Chase Private Client. You will need to get a coupon with an upgrade code using our link below before visiting a Private Client Banker.

Once the upgrade is complete, you will have to transfer a minimum amount of $250,000 in new money as outlined below within 45 days and keep that balance for 90 days.

When all the requirements are met, $2000 will be deposited into your account within 30 business days, which you can save or invest. Here are the steps you need to take to qualify for this offer:

- Get a Chase coupon by entering your email on the website using the link below.

- Meet with a Private Client Banker, provide the coupon – and upgrade your account to become a Chase Private Client.

- Deposit $250,000 or more in new money or securities to a combination of eligible checking, savings and/or investment accounts, (excludes: any You InvestSM, J.P. Morgan retirement accounts and CDs) and maintain it for 90 days to receive $2000 in your account.

‘You Invest’ by J.P. Morgan Account – Up to $725 Bonus

This offer is no longer offered on millennialmoney.com and may be expired.

By opening a new You Invest By J.P. Morgan trade account and funding it with $25,000 or more in qualifying new money from a non-Chase account within 45 days, you will gain up to $725 in bonus cash. Get your offer below.

- Open an account online using the link below or get a coupon by entering your email if you want to open an account in a branch.

- Complete activities to qualify (deposit minimum amounts and maintain balance for 90 days)

- Wait for your bonus money, which should reach you within 10 business days of account opening.

The information for You Invest℠ by J.P. Morgan has been collected independently by MillennialMoney.com. The details on this page have not been reviewed or provided by J.P. Morgan Chase.

Ink Business Unlimited and Ink Business Cash Credit Card – Up to $750 Bonus

You can earn a $750 bonus in cashback if you spend $7,500 during the first three months after opening your account.

Balance transfers, money orders, traveler’s checks, foreign currency, or any other transactions do not apply toward your $7,500 spending threshold. Only purchases from retailers and online stores apply.

Once your purchases’ total reaches the required amount, you will receive the bonus as cash amounting to $750.

It might take up to eight weeks for the points to reach your account, so be patient, and you will be rewarded.

- Sign up for Ink Business Unlimited or Ink Business Cash credit card on the Chase bank website.

- Make purchases using your new card for a minimum of $7,500 during the first three months.

- Receive $750 bonus in cash.

Chase Freedom Unlimited Credit Card Promotion – $200 Cashback

When you apply for the Chase Freedom Unlimited credit card through Millennial Money you can get $200 cashback.

Once you get your card you have to spend $500 on purchases within three months and you will receive a $200 cash back bonus.

This offer is only valid for new cardholders.

- Order your Chase Freedom Unlimited credit card from Chase.

- Spend $500 on purchases in the first 3 months.

- Redeem $200 in cashback bonus.

Refer Your Friends Promotion – Up to $500 a Year

Chase Deposit Check Phone

You can earn up to $500 per year when referring friends or family to join Chase Bank. An existing Chase client with checking and savings accounts and Chase credit cards can invite friends or family members by entering their email addresses.

For each friend you refer, you will earn $50 once your friend opens a new account — a Chase Total Checking or/and Chase Savings using the coupon they received from you.

You can invite as many friends as you want, but it’s worth bearing in mind that you can only receive up to 10 bonuses in a year.

Here’s how to earn your $50 per friend or family member:

Free Chase Deposit Slip Printable

- Invite your friends and family to open an account with Chase through the website.

- Earn $50 each time someone you referred opens an eligible account up to $500 a year.

- Your friends will still benefit from the promotion of up to $350 for new clients.

Chase Sapphire Checking Account Promotion

This offer is expired.

Get a $1,000 bonus when opening or upgrading to a Chase Sapphire Checking account.

To receive your Chase checking account bonus, you will have to transfer at least $75,000 to your newly opened or upgraded account within the first 45 days of account opening and maintain this balance for 90 more days at the very least.

Once the time window is up, you will receive $1,000 within 10 business days to your Chase Sapphire Checking account. This promotion is so easy you can complete it in three easy steps:

- Open a new Chase Sapphire Checking account or upgrade an existing account.

- Transfer a minimum of $75,000 in funds within 45 days of opening your account.

- Maintain this balance for 90 days – and receive $1,000 in your account.

Chase College Checking Account Bonus – $100 Bonus

Qualifying for this bonus is easy. All you have to open a new Chase College Checking Account, enroll in paperless statements, and make sure to complete 10 transactions within 60 days of the account opening (trust me, it sounds harder than it actually is!).

The transactions that can be done are debit card purchases, Chase QuickDeposits, online bill payments, direct deposits, checks paid, and Chase QuickPay with Zelle. $100 is all yours as long as you complete all the steps.

- Open a Chase College Checking account online or enter your email to receive a coupon if you wish to open your account at a branch.

- Sign up for paperless statements.

- Complete 10 transactions from the list within 60 days.

- Enjoy no monthly service fee if you are a college student under 24 (up to 5 years).

Chase Coupons

If you have come across a Chase promotion you will probably need a coupon or a coupon code to redeem the offer.

How Can I Get Chase Coupons?

To get a coupon you can use with applicable offers, simply use our links above for qualified promotions.

Fill in the details, including your email address, and you will receive your coupon in your inbox. Be sure to check the Junk or Spam folder if the email does not show up within a few minutes.

If you are heading to a Chase Bank branch, don’t forget to print out the coupon and take it with you. You can also redeem coupons online by entering the coupon code when asked to during the sign-up process.

If you know someone who is already a Chase customer, you can also ask them to send you an invitation. You and your friend would both receive special offers.

Chase Promotion FAQs

Does Chase have any promotions right now?

Chase routinely offers a number of different promotions that can help businesses as well as individuals. The promotions are usually available for both new and existing customers.

New promotions come out all the time, so check chase.com from time to time to see which offers you can claim on any given day.

Does Chase Bank give money for opening an account?

Yes, Chase Bank will give you a bonus of up to $200 for opening a checking account as noted above.

About Chase Bank And Its Checking Accounts

Banking is part of our everyday lives, so choosing a bank requires some thought. Other than the cash bonus you can earn by opening a Premier Checking or Total Checking Account with Chase, why else should you bank with Chase?

I like Chase’s approach. You can access top-notch mobile apps and other online banking tools such as online bill pay through chase.com.

But the bank also has lots of physical branches — almost 5,000 spread across 40 states and D.C. — and about 16,000 ATMs which means you can access money directly 24/7 in most areas.

You could earn interest on your balance in a Chase Premier Plus Checking Account but the rate will pale compared to an online bank. Chase’s current checking interest rate is 0.01 percent APY. The same is true for Chase’s savings account interest rates.

What you get from Chase is convenience and local access to your money through the bank’s large network of ATMs and branch offices. You can access your savings account balance through an ATM, too.

Plus, the bank has mortgages, personal loans, certificates of deposit, investment accounts, and a variety of savings accounts.

To keep your checking bonus amount you’ll need to keep the new account open for at least six months. If you close the account within six months, Chase will deduct your bonus from your account balance before closing the account.

Chase will report your bonus as paid interest to the IRS.

What About Monthly Fees?

Both the Total and Premier Checking accounts charge monthly fees that you can waive pretty easily.

- Total Checking ($200 bonus offer): The $12 monthly maintenance fee will be waived if you keep an average minimum daily balance of $1,500, receive $500 in qualifying direct deposits each month, or keep a minimum $5,000 daily combined balance in your Chase deposit accounts.

- Premier Checking ($300 bonus offer): The $25 monthly maintenance fee will be waived if you keep an average minimum daily balance of $15,000 in your Chase checking, savings, or other deposit accounts. You can also waive the fee if you have a Chase mortgage with automatic payments from the checking account. Also, Chase does not charge this monthly fee to current and former military members.

What is a Qualifying Direct Deposit?

Direct deposits qualify to exempt you from Chase’s monthly service fees if they come from your employer or from government benefits such as Social Security.

Transfers between accounts or through services such as Venmo or PayPal will not qualify. Neither will Chase ATM transactions or automatic transfers between your Chase savings account and your checking.

What About Overdraft and Other Fees?

Almost all banks charge fees for overdrafts and other services. Here’s how Chase’s fees line up:

Chase Deposit Check Online

- Overdraft: $34 per transaction up to 3 times a day.

- Non-Chase ATM Use: $2.50 fee from Chase; other banks will charge too. ($5 outside of U.S. or Puerto Rico.)

- Debit Card Replacement Shipping: $5 if you choose to expedite shipping; free for standard shipping.

These fees align with the fees you’d pay with other large national banks such as Citibank and Wells Fargo.

Along with the bonus paying Total Checking and Premier Plus Checking, Chase offers checking accounts designed for high school and college students, both of which have more generous terms. Chase also has Private Client Checking with a variety of perks for high wealth clients with $250,000 or more in assets.

About Chase Bank’s Credit Cards

Chase’s bonus offers on credit cards come with some other nice perks such as cashback and no annual fees:

- Ink Business Unlimited: 1.5 percent cash back on all purchases with no annual fee; 0 percent APR for qualified applicants during the first 12 months. (13.24% – 19.24% variable APR thereafter)

- Ink Business Cash: 5 percent cashback in some business expense categories with no annual fee; 0 percent APR for qualified applicants during the first 12 months. (13.24% – 19.24% variable APR thereafter)

- Freedom Unlimited: 1.5 percent cash back on all purchases with no annual fee.

When you use a credit card like the Chase Freedom Unlimited to make your regular household purchases each month — and then pay off the entire balance — you can get 1.5 percent cash back on a big portion of your monthly expenses.

About Chase’s ‘You Invest’ Investment Accounts

Chase’s You Invest service and its app dovetail nicely with Chase Bank’s other online services. You can transfer money seamlessly between your deposit accounts and your investing account.

Because Chase is a bank, it’s important to understand your invested cash will not have FDIC protections like your checking, savings, or CDs. Your investment account could lose value.

You Invest lets you open a taxable account, a traditional IRA or a Roth IRA.

If you have $2,500 or more in your investment account you can use Chase’s Portfolio Builder, a robo-advisor, at no charge. (The leading robos usually charge at least 0.25 percent of your account’s balance per year.)

If you’d rather have some guidance — which isn’t a bad idea — open a You Invest Portfolio account. You’d pay 0.35 percent annual management fee.

Overall, You Invest provides the basics any beginning investor could need, but more advanced investors may want a service with more options.

There Are Many Ways to Save With Chase Bank

Whether you are new to banking, looking to change your bank to Chase, or an existing Chase client, you can find ways to save or earn bonuses through the bank.

Chase Deposit Atm

I’ve highlighted the main ways to save money and get bonuses with Chase Bank, but remember to check chase.com for new offers that pop up all the time.

Chase Bank offers cashback options for many of its credit cards and payment waivers for account holders. Don’t miss the opportunity to up your savings game by taking advantage of these offers and promotions.

Chase Bank Bonuses Can Help Jump Start Your Savings

Chase Deposit Limit

I recommend Chase Bank to readers who want to start a relationship with a large brick-and-mortar bank with locations around the country. You could earn more interest with an online savings account but you won’t get the same level of customer service.

If you’re already considering a new bank, or if you’re shopping to open your first-ever account, bank bonuses like the Chase checking account bonuses may provide the incentive you need.

The key to using bank bonuses is to save or invest the bonus, if possible. Move the money into a savings account and be sure to set up direct deposits into your checking account so you can avoid the monthly maintenance fee.