Pnc Direct Deposit

Posted By admin On 16/07/22PNC Bank Routing Numbers and Wire Transfer Instructions

- The PNC Bank direct deposit authorization form is a standard method for authorizing an entity, such as an employer, to deposit payments directly to a PNC Bank Account of your choosing. Some employers may have their own forms or procedures, so it is generally recommended to check with this entity before submitting this form.

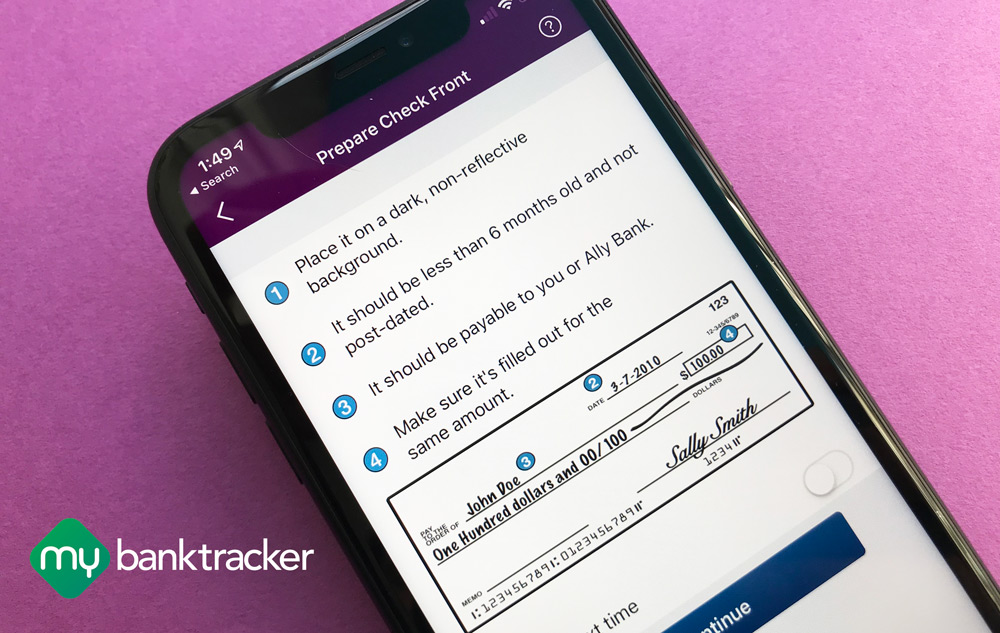

- PNC customers deposit on average over 2 million checks per month using their mobile devices! See how easily you can deposit a check right from your smartphone — quickly, conveniently, and securely with mobile deposit and our mobile banking apps.

Quick find guide:

How do I find routing numbers?

What is a routing number?

How do I setup a direct deposit?

How do I receive money from outside the United States?

Wire Transfer Information

Direct Deposit With Direct Deposit, your paycheck, dividend, pension or Social Security check can be automatically deposited into your PNC checking account. Have your deposit made for you With Direct Deposit, have your paycheck or any regularly scheduled payment deposited electronically into your checking, savings or money market account. Direct deposit allows employers to send your paycheck directly to your checking or savings account. Most of the time, this process takes one to three days. PNC, Chase Bank, Citibank, Bank of.

How much does it cost to complete a wire transfer?

How long does a transfer take?

READ MORE:LendingClub vs LendingTree personal loan review.

How do I find routing numbers?

1. Look at the bottom left of your PNC Bank paper check.

2. If you live in Lower Saxony, we've compiled a list of your essential routing numbers for PNC Bank.

ABA: See Website

ACH: See Website

Wire Transfer: See Website

SWIFT/BIC Code for USD Denominated Transfers: PNCCUS33

3. Simply visit here to view all the PNC Bank routing numbers for each routing number associated with all regions.

4. View the routing numbers on PNC Bank's website.

What is a routing number?

ABA: (American Bankers Association number), also known as a Routing Transfer Number (RTN) is a nine-digit code that normally appears on the bottom of paper checks. This routing number is used to correctly identify the issuing financial institution. ABA numbers can be the same as wire numbers, and vary from financial institution. Ensure you check with your bank that you're using the right one.

ACH: (Automatic Clearing House number) is an electronic payment delivery system primarily used for direct deposits, making payments, and collecting funds. Most employers will use this routing number when setting up direct deposits for employees pay. It can also be used for when setting up auto-pay with different companies.

Wire: Some banks will require a different routing number used for wire transfers. It can be the same as an ABA or ACH number, and varies on the issuing institution. Simply the fastest method of sending/receiving funds, unless you are using a service like Transferwise, in which funds would be transferred immediately. Money can be available in as little as one day with a wire transfer, but international wire transfers could require you to wait up to six business days. The only downfall with this payment method is that financial institutions will charge large fees associated with the quick availability of funds.

SWIFT/BIC: (Society for Worldwide Interbank Financial Telecommunication / Bank Identifier Code) is a code used to identify financial institutions worldwide. The code can be 8 or 11 digits long, and will have different parts associated with it. The first four characters identify the bank, the next two will identify the country, and the last two will identify the location. If the code is a total of 11 digits, the ending three digits will identify the branch. If the last three are XXX, this means that the SWIFT/BIC code belongs to the main branch. Anything deviating from XXX will identify a secondary or local branch.

BEST:BBVA Compass Bank to offer free $200 bonus on credit cards.

How do I setup a direct deposit?

In order to setup a direct deposit, you will simple need the ACH number, also known as a routing number: See Website (Lower Saxony), and your checking account number. Savings accounts can also be used for direct deposit but some banks may have limitations on these types of transactions, potentially charging you a fee for the amount of times you transfer money inbetween accounts. Many employers will have an option to allow you to setup direct deposit, instead of receiving a physical check every pay period.How do I receive money to PNC Bank from outside the United States?

In order to conduct these type of transfers, you will need to consider a wire transfer. Below are the two types of wire transfers for international use. Please note that some banks will have different receiving information for U.S. dollar and foreign denominated currency transfers.The sender will need the following information to successfully send money to your Bank of America account. Ensure the SWIFT/BIC number is given correctly to ensure there is no issue in receiving your transfer. Some banks have different SWIFT/BIC codes for foreign currency and US dollar transfers due to the conversion rate of different currencies. Also note that the cost to send a wire transfer can be substantial.International Wire Transfer Information

Use this information to receive funds internationally.| Bank Details | Values |

|---|---|

| Bank Name | PNC Bank N.A. |

| Bank Address | 222 Delaware Avenue |

| Bank City, State, and Zip | Wilmington, DE 19899 |

| SWIFT/BIC Code | PNCCUS33 |

| Lower Saxony Routing Transfer Number | |

| Beneficiary Account Number | Your complete PNC Bank account number (including leading zeros) |

| Beneficiary Name | The name of your account as it appears on your statement |

How much does it cost to complete a wire transfer?

Banks tend to charge between $10 and $30 for domestic wire transfers, and between $30 and $50 for international wire transfers. In 2018, wire transfer fees can be avoided by using services like transferwise.

Banks only charge so much because they can. Realistically, for a bank to convert money from one currency to another costs a fraction of what they charge. This is the most recommended service due to how fast it takes and the minimal fees paid. Below is a chart comparing national banks and what they charge to transfer funds internationally.

Cost to convert $1,000 into Euros to send internationally

| Bank | International Outgoing Fee |

|---|---|

| BBVA Compass | $45.00 |

| Navy Federal Credit Union | $25.00 |

| Kinetic Credit Union | Varies |

| Citizens Bank | $60.00 |

| USAA | $45.00 |

| Capital One Bank | $40.00 |

Transferwise | $8.45 |

How long does a transfer take?

Depending on the financial institution and where the sending bank is located, it can take between one and six business days. Typically for domestic transfers, it will take one day, and for international wire transfers, it can take between three and six. After seven business days and if you haven't seen any new transactions in your account, contact your bank to see what the problem might be. PNC Bank Fees

and Charges

Do you always know what bank fees and charges you are going to pay when you open an account? Many banks charge fees for behaviors many customers did not even realize they were being charged for. These fees could be PNC overdraft fees, checks cost, safe deposit box cost, or something as hidden as paper statements.

Banking like it should be.

Signing up is free and takes less than 2 minutes.

✓ No monthly fees. No minimum balance. No overdraft

✓ Get your paycheck up to 2 days early

✓ Grow your savings automatically

Learn how we collect and use your information by visiting our Privacy Policy›

Types of Fees and Charges

PNC can have some of the steeper fees and charges that banks may charge. They are more transparent on their website about the charges, though, and it is much easier to identify the fees than with most other banking institutions.

Overdraft Charges

- Overdraft fees are charged per item that overdrafts the limit. Beware of a multitude of overdraft fees that can result in a quick $100+ in fees, however unlike most banks, PNC has an overdraft limit of 4 times a day, so the highest you can be charged in overdraft fees in one day is $144. PNC also has a $7 fee for each day your account is still overdrawn. Anytime your account balance drops below zero, this fee is charged per transaction.

Overdraft Protection Transfer From Linked Savings Account

- This fee is charged for the convenience of PNC Bank transferring money from your savings into your checking account. This fee is also paid on a per-item basis, so it can add up just as quickly as the overdraft fees.

Wire Transfer

- Wire transfers occur when money is electronically transferred from one bank account and deposited into another. Wire transfer charges vary depending on domestic or international services. Domestic wire transfer fees for the performance checking account are waived altogether. These fees can also occur when money from your PNC checking account transfers to another bank, even if both are in your name.

Paper Statements

- For some of the checking accounts PNC bank charges for paper statements. This extra $2 a month can add up over time, especially if you are a long-term customer. Adding images of checks on the paper statements will add another $1 per month.

Safe Deposit Box

- Safe deposit boxes are a service that PNC Bank’s offer to keep your valuables protected by multiple levels of security. The bank keeps a key, and you receive a key. The PNC safe deposit box cost can vary depending on the bank and the size, but they range from $42 for a 3×5 box to $75 for a 10×10 box.

Early Account Closure Fee

- PNC Bank charges a $25 fee to close an account that has been open for less than 180 days. It is important to keep this in mind when opening a PNC account, or the monthly service fees can add up or paying to close your account can be costly.

Checking Accounts

PNC Bank offers traditional checking accounts such as the standard, performance, and performance select accounts. They each have their own service fees and changes, but they do all have a minimum opening amount of $25.

Standard Checking

This is the lowest tier of checking accounts with a service charge of $7. This monthly service fee can be waived by completing any of the following: $500 average monthly balance in this account, $500 in qualifying monthly direct deposits to this account during the statement period, or if the account holder is age 62 or over.

Performance Checking

This checking account is PNC Bank’s middle tier checking account with a service charge of $15. The monthly obligation can be waived by completing any of the following: $2,000 average monthly balance, $15,000 combined average monthly balance across linked PNC Bank consumer deposit, loan and/or PNCI investment accounts, or $2,000 in qualifying monthly direct deposits to this account during the statement period ($1,000 for WorkPlace or Military Banking customers). The benefit to this account compared to the standard checking is that interest is earned on the balance.

Performance Select Checking

The highest tier checking account that PNC bank offers is the performance select It charges a $25 monthly fee. This monthly obligation can be waived by meeting one of the following requirements: $5,000 combined average monthly balance in this and up to 8 linked PNC Bank consumer checking accounts, $25,000 combined average monthly balance across linked PNC Bank consumer deposit and/or PNCI investment accounts, $5,000 in qualifying monthly direct deposits to this account during the statement period. TTe monthly direct deposit necessary is $5,000. Monthly service fees are also waived on up to 8 additional consumer checking, saving, or money markets accounts that are linked to your performance checking.

Pnc Direct Deposit Holiday

Pnc Direct Deposit Schedule

Savings Accounts

In addition to putting your money into a checking account, you can also invest your money in a PNC savings account, PNC Premiere Money Market account, or a Certificate of Deposit (CD). These accounts will accumulate more interest than the checking accounts that are offered, but the money is less liquid. Therefore, there are higher fees or limits to removing your money.

Certificates of Deposit are savings accounts that pay a fixed interest rate for a set period of time, beginning at 7 days up to multiple years, to ensure that the money deposited will stay in the account. By depositing your money into a CD for a set term, you lock in your initial deposit principal and interest rate until your money matures. Your interest compounds daily and is generally paid monthly, although interest payments made quarterly, semi-annually, annually, or at maturity are also available. The interest rates on these accounts are much higher than an interest rate on a general savings account. There are very hefty fees for withdrawing the money early; however, PNC bank does not disclose what these fees are.

Premiere Money Market accounts have a $100 minimum deposit to open the account and have a $12 monthly service fee. The fee for premiere money market accounts can be waived if the account holds an average monthly balance of at least $5,000.

The other savings account offered by PNC Bank has a $25 minimum deposit to open and a $5 service charge that can be waived by meeting any of the following requirements: $300 average monthly balance in this account, at least one Auto Savings transfer of $25.00 or more each month from your PNC checking, account holder is under age 18, or first year for Foundation Checking customers.

PNC Virtual Wallet

PNC Virtual Wallet helps you manage all of your money in one place. You can pay bills, track spending by category, set savings goals, and more. The Virtual Wallet is made up of, what they call, Spend, Reserve, and Growth. Spend represents a primary checking account, Reserve represents a short-term savings account, and Growth represents a long-term savings account. There are three different levels of virtual wallet: the regular virtual wallet, performance spend virtual wallet, and performance select virtual wallet.

The fees between the accounts are the same as the normal checking accounts, but the monthly fees can be waived easier because the funds in the accounts can be combined to meet the minimum. For instance, the $7 for the monthly service fee for Virtual Wallet service charge can be waived with $500 combined average balance in Spend and/or Reserve accounts. The standard PNC Virtual Wallet fees are the same fees for the Standard checking account.

The Performance Spend virtual wallet has the same fees and charges as the PNC Performance checking account. The Virtual Wallet service charge can be waived with $2000 combined average balance in Spend and/or Reserve accounts.

The Performance Select account has the same fees and charges as the PNC Performance Select checking account. The monthly service fees of $25 can be waived with $5000 combined average balance in Spend and/or Reserve accounts, or 6 PNC Bank consumer checking accounts that have been linked.

When opening a PNC Bank’s account, whether it be checking, savings, virtual wallet or a CD, it is important to know and understand penalties and withdrawal limits for each.

2 minutes with no impact to your credit score.